In our latest study, together with the RAG-Stiftung, we take a closer look at the health sector – a part of the startup ecosystem that impacts all of us. This article summarises the report´s key findings on where Germany stands in health innovation and how the Ruhr region can further strengthen its health clusters.

We all benefit from innovation in the health sector – without the new mRNA vaccines, for example, neither the economy nor society in general would have been able to return to some kind of normality during the coronavirus pandemic. Germany has long been an international pioneer in this field, driven by the transfer of knowledge and technology between research institutions and the commercial sector. And success stories such as BioNTech are testimony to what Germany is still capable of delivering in this field today. Over the past few years, however, Germany – once considered the ‘pharmacy of the world’ – has lost its leading position in the health sector. So, what have other countries been doing better? And how can Germany catch up again? Our new report addresses these questions, while focusing on startups in the health sector, their ecosystem and Germany’s Ruhr region – that offers great potential in this heavily research-dependent sector.

Germany is lagging behind in innovation

The link between cutting-edge research and applied medicine has never been more significant than it is today. It is interesting to note that the companies that have successfully developed the first vaccines against the coronavirus, the German firm BioNTech and USA-based Moderna, were both founded in the past 15 years. This just goes to show how important startups truly are for the healthcare sector.

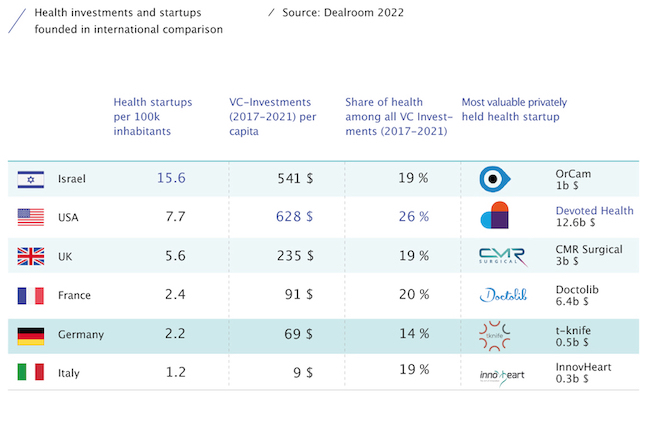

So, what is the current situation with startups and innovation in the healthcare sector in Germany? If we look at key indicators at an international level, we see that Germany is lagging way behind pioneers such as the USA. In the USA, for example, three to four times as many health startups are founded per capita and capital invested is nine times higher. Even in comparison to the United Kingdom, whose healthcare system is more state-organised, Germany is still significantly falling behind.

Opportunities outside startup hotspots

To help explain these differences, it’s worth taking a step back and looking at the investment figures in the startup ecosystem overall. When we do this, we notice that the 10 startups that have attracted the largest venture capital funding rounds over the past 5 years are all based in the hotspots Berlin and Munich. Home to the fastest-growing software, technology and e-commerce companies, these two cities – into which the majority of capital has flown to date – clearly dominate the general startup scene.

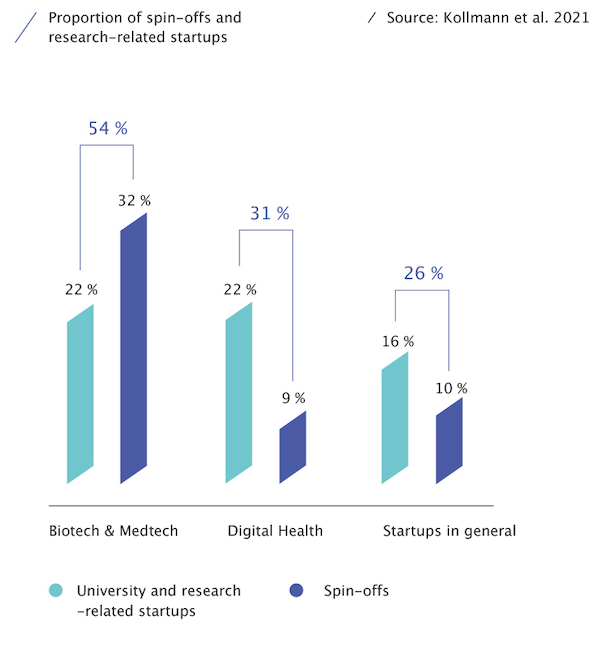

However, the picture is different in the healthcare sector. Here, startups in Mainz, Tübingen and Hannover have attracted the largest funding rounds in the last years. Duisburg has also secured a place in the top 10, with its biotech startup Emergence Therapeutics. In the biotech and medtech sectors in particular, common patterns are being broken and many new clusters can be found throughout Germany. Data from the German Startup Monitor reveals a key point here: 54% of biotech and medtech startups are scientific spin-offs or have been supported by universities or research institutions.

Today, healthcare is a sector that offers potential for locations with a strong research and healthcare infrastructure. Metropolitan areas such as the Ruhr region, with an extensive research landscape and large university hospitals, provide the prerequisites for a functional startup ecosystem in the healthcare sector. Success with financing, as seen in the cases of Abalos and Emergence Therapeutics, as well as the impressive exit of the medtech company phenox, confirms the potential offered by the Ruhr region. However, like many other regions, the Ruhr still has some catching up to do to achieve a more dynamic startup scene. After all, the more startups there are, the more the ecosystem benefits from growing synergies and a tighter-knit network. As a consequence, this improves quality, ensures higher chances of success at the top and strengthens the ecosystem over the long term.

Science must meet Entrepreneurship

Germany has produced the most Nobel Prize winners in chemistry and physics after the USA – and Germany still continues to play a leading international role in fields of research that are key for the biotech and medtech sectors. The problem, however, is that these strengths are too rarely translated into practical applications. There are diverse explanations for this, including a lack of a suitable framework for exploiting patents, insufficient incentives for scientists or gaps in available funding or support. Although the notion of the entrepreneurial mindset frequently crops up in this context, our conversations with founders clearly underlined just how much the mindset depends on the infrastructure in place to help new business get off the ground. Good framework conditions increase the chances of success and provide an attractive incentive to those looking to set up a business.

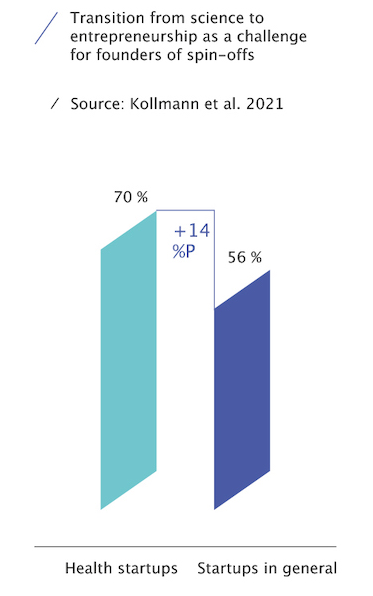

However, research is not the only sector in which things need to change. 70% of science-based founders in the healthcare industry consider the transition to a business environment to be particularly challenging. This underlines the necessity for the business world – successful founders, investors and established companies – to establish closer links to research to enable knowledge transfer, share experience and get promising projects off the ground more quickly. Particularly in the healthcare sector, it is vital that traditional support for startups be reinforced with strong partnerships and networks in the business world.

Another important element in the development of startup ecosystems in the healthcare sector is the networking of key players. This industry faces its own specific challenges, with many of the people interviewed describing it as ‘very demanding’. For example, research and development is extremely long-winded and cost-intensive before the first products are anywhere near market-ready. It may take several years, for instance, until a drug finally reaches the market. Furthermore, startups in the healthcare sector operate in a highly regulated market and require access to infrastructure, hospitals and doctors. These characteristics of the industry mean that we need to think differently and, above all, more long-term – especially when it comes to financing.

Targeted support and financing

If we want to create a more dynamic startup scene in the healthcare sector, we need to put targeted measures into place to address the needs and requirements of new ventures:

- by encouraging universities and research institutions to reinforce entrepreneurial incentives for scientists and simplify intellectual property-related processes,

- by ensuring that startup support programs close to universities and research, provide practical business expertise, focus on the development of sector-specific ecosystems and bring research and business closer together, and

- by further supporting them with the essential funding: a specific Seed&Scale programme can help drive startups forward and put them in touch with investors.

The report „Gesundheit meets Innovation – Startups für Impact und Wachstum im Ruhrgebiet“ is available in German and can be downloaded here.